Digital Library[ Search Result ]

Time Series Data Imbalance Resolution Techniques for Early Prediction

Eungseon An, Taehyoung Kwon, Doguk Kim

http://doi.org/10.5626/JOK.2025.52.7.593

Time series forecasting is a critical task that involves analyzing observed time series data to predict future values. However, when dealing with imbalanced data, model performance can degrade, leading to biased predictions. Although recent studies have explored various deep learning techniques and data augmentation methods, many fail to address challenges posed by data imbalance and the intrinsic characteristics of time series data simultaneously, leaving underlying issues unresolved. This study proposed a novel approach that could leverage temporal patterns to generate synthetic samples and extend the scope of early prediction. By identifying key moments that could effectively distinguish between positive and negative classes, our method enhanced the ability to predict further into the future. The method proposed in this study demonstrated superior performance to existing methods and proved the feasibility of early prediction for longer time lags.

Improving Portfolio Optimization Performance based on Reinforcement Learning through Episode Randomization and Action Noise

http://doi.org/10.5626/JOK.2024.51.4.370

Portfolio optimization is essential to reduce investment management risk and maximize returns. With the rapid development of artificial intelligence technology in recent years, research is being conducted to utilize it in various fields, and in particular, investigation on the application of reinforcement learning in the financial sector. However, most studies do not address the problem of agent overfitting due to iterative training on historical financial data. In this study, we propose a technique to mitigate overfitting through episode randomization and action noise in reinforcement learning-based portfolio optimization. The proposed technique randomizes the duration of the training data in each episode to experience different market conditions, thus promoting the effectiveness of data augmentation and exploration by leveraging action noise techniques to allow the agent to respond to specific situations. Experimental results show that the proposed technique improves the performance of the existing reinforcement learning agent, and comparative experiments confirm that both techniques contribute to performance improvement under various conditions.

Time-Series Data Augmentation Based on Adversarial Training

http://doi.org/10.5626/JOK.2023.50.8.671

Recently, time series data are being generated in various industries with advancement of the Internet of Things (IoT). Accordingly, demands for time series forecasting in various industries are increasing. With acquisition of a large amount of time-series data, studies on traditional statistical method based time-series forecasting and deep learning-based forecasting methods have become active and the need for data augmentation techniques has emerged. In this paper, we proposed a novel data augmentation method for time series forecasting based on adversarial training. Unlike conventional adversarial training, the proposed method could fix the hyperparameter about the number of adversarial training iterations and utilize blockwise clipping of perturbations. We carried out various experiments to verify the performance of the proposed method. As a result, we were able to confirm that the proposed method had consistent performance improvement effect on various datasets. In addition, unlike conventional adversarial training, the necessity of blockwise clipping and the hyperparameter value fixing proposed in this paper were also verified through comparative experiments.

Search

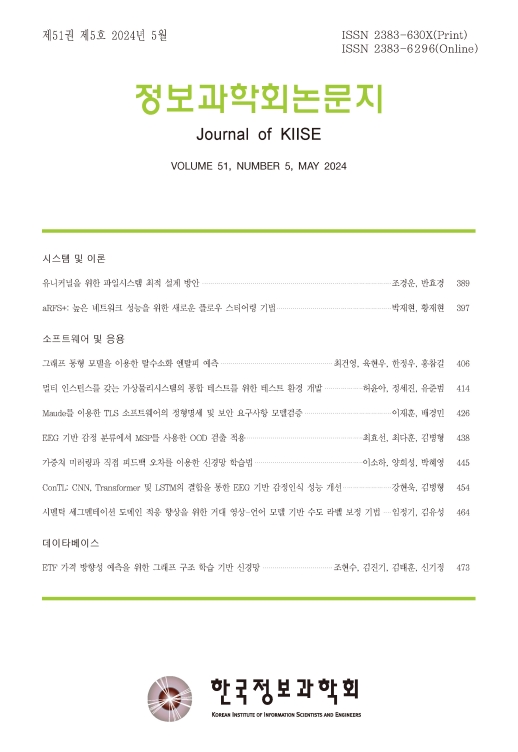

Journal of KIISE

- ISSN : 2383-630X(Print)

- ISSN : 2383-6296(Electronic)

- KCI Accredited Journal

Editorial Office

- Tel. +82-2-588-9240

- Fax. +82-2-521-1352

- E-mail. chwoo@kiise.or.kr