Digital Library[ Search Result ]

Improving Portfolio Optimization Performance based on Reinforcement Learning through Episode Randomization and Action Noise

http://doi.org/10.5626/JOK.2024.51.4.370

Portfolio optimization is essential to reduce investment management risk and maximize returns. With the rapid development of artificial intelligence technology in recent years, research is being conducted to utilize it in various fields, and in particular, investigation on the application of reinforcement learning in the financial sector. However, most studies do not address the problem of agent overfitting due to iterative training on historical financial data. In this study, we propose a technique to mitigate overfitting through episode randomization and action noise in reinforcement learning-based portfolio optimization. The proposed technique randomizes the duration of the training data in each episode to experience different market conditions, thus promoting the effectiveness of data augmentation and exploration by leveraging action noise techniques to allow the agent to respond to specific situations. Experimental results show that the proposed technique improves the performance of the existing reinforcement learning agent, and comparative experiments confirm that both techniques contribute to performance improvement under various conditions.

Search

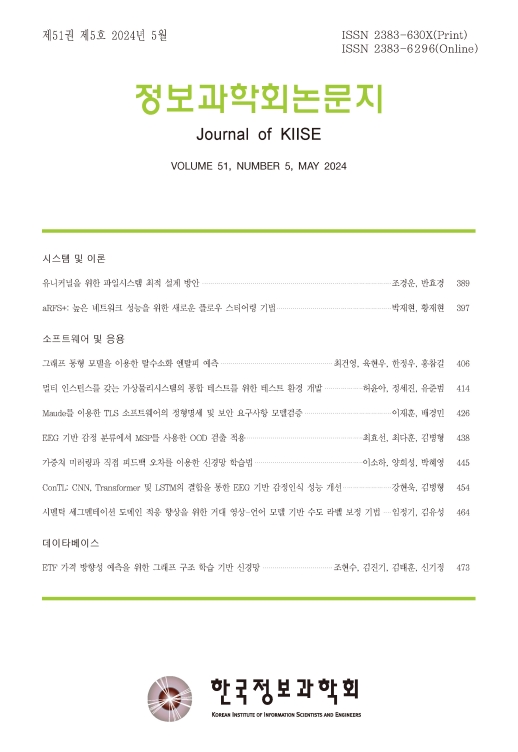

Journal of KIISE

- ISSN : 2383-630X(Print)

- ISSN : 2383-6296(Electronic)

- KCI Accredited Journal

Editorial Office

- Tel. +82-2-588-9240

- Fax. +82-2-521-1352

- E-mail. chwoo@kiise.or.kr