Digital Library[ Search Result ]

A Study on Improving the Accuracy of Korean Speech Recognition Texts Using KcBERT

Donguk Min, Seungsoo Nam, Daeseon Choi

http://doi.org/10.5626/JOK.2024.51.12.1115

In the field of speech recognition, models such as Whisper, Wav2Vec2.0, and Google STT are widely utilized. However, Korean speech recognition faces challenges because complex phonological rules and diverse pronunciation variations hinder performance improvements. To address these issues, this study proposed a method that combined the Whisper model with a post-processing approach using KcBERT. By applying KcBERT’s bidirectional contextual learning to text generated by the Whisper model, the proposed method could enhance contextual coherence and refine the text for greater naturalness. Experimental results showed that post-processing reduced the Character Error Rate (CER) from 5.12% to 1.88% in clean environments and from 22.65% to 10.17% in noisy environments. Furthermore, the Word Error Rate (WER) was significantly improved, decreasing from 13.29% to 2.71% in clean settings and from 38.98% to 11.15% in noisy settings. BERTScore also exhibited overall improvement. These results demonstrate that the proposed approach is effective in addressing complex phonological rules and maintaining text coherence within Korean speech recognition.

A Study on Development of Technology to Improve Imbalanced Data Problems in Numerical Dataset Using Tomek Links Method combined with Balancing GAN

Hyunsik Na, Sohee Park, Daeseon Choi

http://doi.org/10.5626/JOK.2020.47.10.974

Machine Learning is useful due to its good performance and application in various fields such as data classification, voice recognition and predictive models. However, there exists a problem regarding the imbalance between classes in the training dataset, which degrades the classification performance of the minority class. In this paper, we propose a new data augmentation method that combines the Balancing GAN and Tomek Links Method to solve the Imbalanced Data problem and find a clear decision boundary. To verity the proposed method, we have evaluated the performance according to the classification model using five datasets. Moreover, the performance has been compared with Data Sampling and GAN based Data Augmentation Techniques. The results showed that the classification performance was improved or maintained by 0.05~0.195 in 17 of the total 25 performance evaluations. The method proposed in this paper showed the potential as a new method to solve the Imbalanced Data problem.

The analysis of Loan status and Comparison of Default Prediction Performances based on Personal Credit Information Sample Database

http://doi.org/10.5626/JOK.2019.46.7.627

In this paper, we analyze the status of loans and defaults and present statistical data according to the borrower"s gender, age, month, etc. by using the personal credit information sample database offered as a trial service from Korea Credit Information Services. In addition, since domestic and foreign banks are paying attention to minimize the loss caused by default of the borrower, we used the personal credit information sample database to create a predicting model of borrower default and evaluated the model performance. To predict the default for a certain month, the borrower"s demographic information and loan information for the previous six months were processed to generate characteristic data, and a default prediction model was created using Recurrent Neural Network and machine learning algorithm. Based on the performance of each model, Recurrent Neural Network was showed as the model to demonstrate the best performance with Recall of 0.96 and AUC of 0.85 for the default borrower.

A Study on P2P Lending Deadline Prediction Model based on Machine Learning

http://doi.org/10.5626/JOK.2019.46.2.174

Recently, there has been an increase in P2P lending users, a product that supports investments through lending among individuals using online platforms. However, since P2P lending`s investors have to take financial risks, the investors may fail to investment due to the close of investment while they considering whether to invest or not. This paper predicts how long an investment product will take from a certain point to the close in order to provide deadline information for P2P loan investment products. To predicts the investment deadline, we have transforms into Timeseries data and Step data based on investment information on actual P2P products. The regression, classification, and time series prediction model were generated using machine learning algorithm. The results of the performance evaluation showed that in the Timeseries data-based model, the Multi-layer Perceptron regression model and the classification model showed the highest performance at 0.725 and 0.703 respectively. The Step data-based model was also the highest with the Multi-layer Perceptron regression model and the classification model at 0.782 and 0.651 respectively.

Search

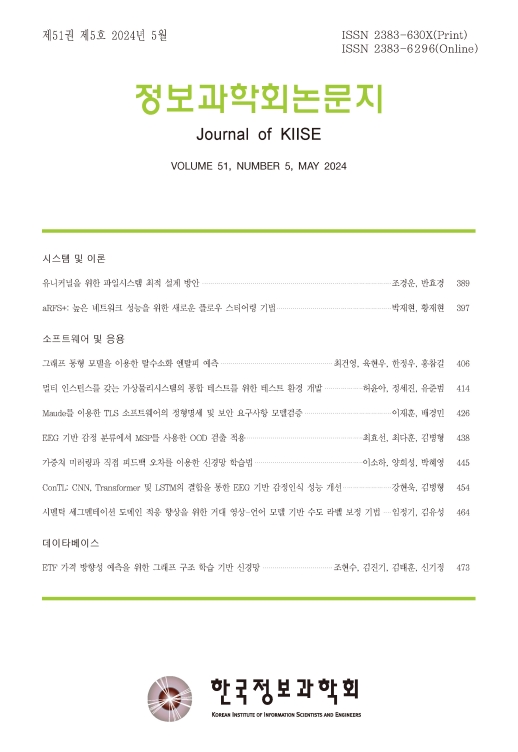

Journal of KIISE

- ISSN : 2383-630X(Print)

- ISSN : 2383-6296(Electronic)

- KCI Accredited Journal

Editorial Office

- Tel. +82-2-588-9240

- Fax. +82-2-521-1352

- E-mail. chwoo@kiise.or.kr